If you’re tired of making sky-high interest rate payments, student loan refinancing may be a good option for you. Refinancing saves you money by replacing your existing student loans with a new, lower-rate loan.

To qualify, you need credit in the mid-600s or higher and a steady income, or access to a co-signer. Student loan refinancing is not the same as federal consolidation. Learn more on our refinance FAQ page.

The best refinance lender for you depends on your priorities. Borrowers often look for the lowest interest rate possible, but it’s worth checking out the various features each lender offers. See our reviews for the full details.

Student loan refinance options

| Lender | APR ranges* | Average credit score |

Eligible loan balances | NerdWallet review |

|---|---|---|---|---|

| *All APR ranges include a 0.25% autopay discount if available. See additional offer disclosures below. | ||||

|

Fixed: 3.37% to 6.74% Variable: Hybrid: |

750+ | $5,000 to $500,000 | CommonBond review |

|

Fixed: 3.37% to 6.49% Variable: |

700+ | $5,000 to $500,000 | Earnest review |

|

Fixed: 3.38% to 6.74 Variable: |

766 | $5,000 up to the full balance of your student loans | SoFi review |

|

Fixed: 3.50% to 7.28 |

770 | $7,500 to $150,000 | Purefy review |

|

Fixed: 4.20% to 7.20% Variable: |

750+ | $5,000 up to the full balance of your student loans | DRB review |

|

Fixed: 3.74% to 8.24% Variable: |

781 | Undergrads: $10,000 to $150,000 | Citizens Bank review |

|

Fixed: 3.35% to 6.69% Variable:2.10-6.01% |

$15,000 to $250,000 | Elfi review | |

Refinance lender details and reviews:

Elfi

- Type of lender: Online only

- Loan servicer: Mohela

- Deferment or forbearance available: Yes

- Co-signer release available: No

- Why it stands out: Elfi offers some of the lowest rates in the market

- Read more about Elfi

Earnest

- Type of lender: Online only

- Loan servicer: Earnest

- Deferment or forbearance available: Yes

- Co-signer release available: Yes

- Why it stands out: The interest rate is customized based on your preferred monthly payment

- Read more about Earnest

CommonBond

- Type of lender: Online only

- Loan servicer: Firstmark Services

- Deferment or forbearance available: Yes

- Co-signer release available: Yes

- Why it stands out: You can refinance a parent PLUS loan in your name

- Read more about CommonBond

SoFi

- Type of lender: Online only

- Loan servicer: Mohela

- Deferment or forbearance available: Yes

- Co-signer release available: No

- Why it stands out: You can get access to career coaching services

- Read more about SoFi

Purefy

- Type of lender: Online only

- Loan servicer: PenFed Credit Union

- Deferment or forbearance available: Yes

- Co-signer release available: Yes

- Why it stands out: Married couples can refinance their loans together

- Read more about Purefy

DRB

- Type of lender: Traditional bank

- Loan servicer: Mohela

- Deferment or forbearance available: Yes

- Co-signer release available: Yes

- Why it stands out: There’s no limit on the loan balance you can refinance

- Read more about DRB

Citizens Bank

- Type of lender: Traditional bank

- Loan servicer: Firstmark Services

- Deferment or forbearance available: Yes

- Co-signer release available: Yes

- Why it stands out: You can refinance even if you didn’t graduate

- Read more about Citizens Bank

When to consider student loan refinance alternatives

YOU’LL USE FEDERAL LOAN REPAYMENT PROGRAMS

When you refinance a federal student loan, a lender pays it off and issues you a new, private loan. That means you can’t repay the refinanced loan on an income-driven repayment plan, postpone payments using deferment or forbearance, or get loan forgiveness for working in public service. Only refinance your federal loans if you don’t plan to take advantage of these programs.

YOU DON’T MEET THE REQUIREMENTS

At a minimum, lenders want to see that you have a stable job and a steady income, that you use credit responsibly and that you’ve been in the workforce for a little while. Some lenders also prefer customers who have graduate degrees, especially if you have a lot of debt. This means refinancing isn’t an option for graduates who are struggling to pay their student loan bills.

More on student loan refinance

Refinance calculator

Refinance vs. consolidation

Refinance FAQs

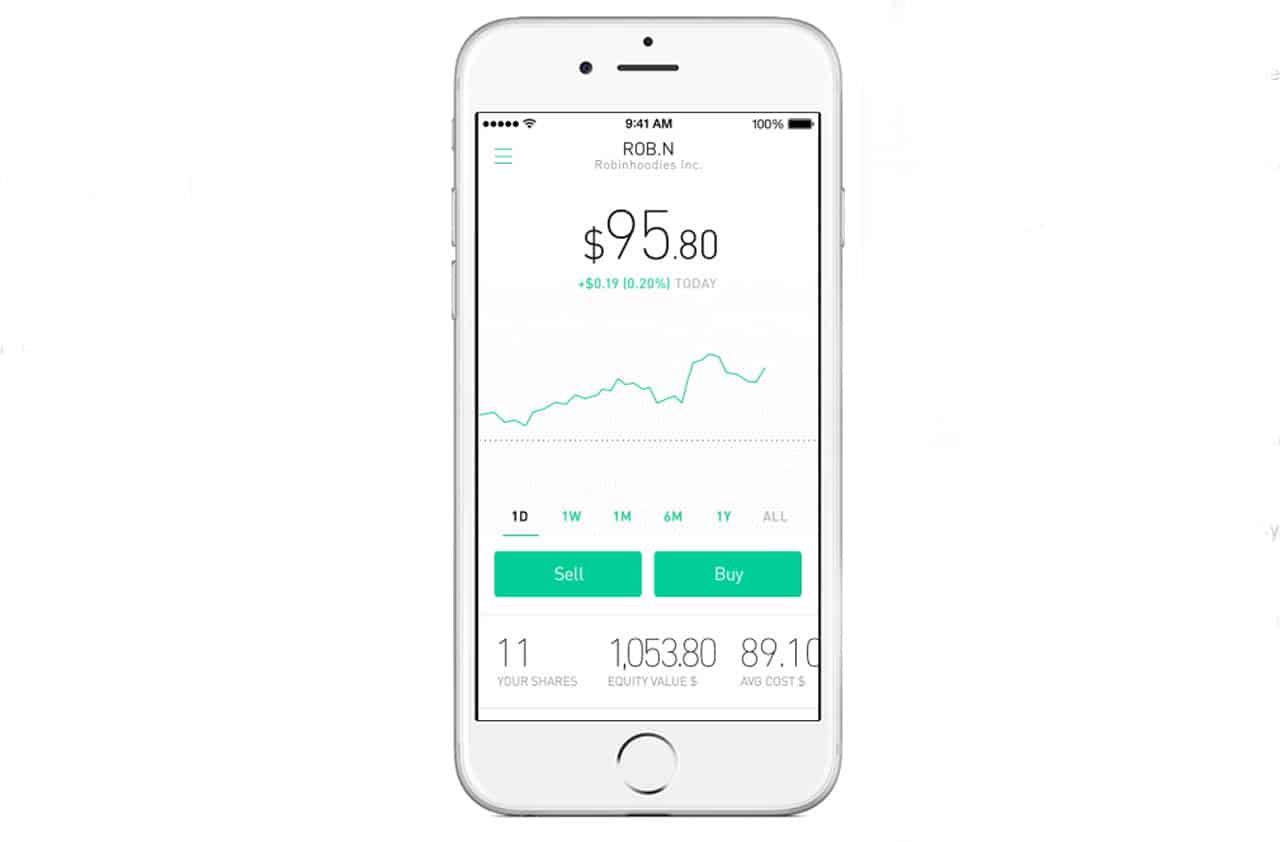

Best Online Stock Brokers for Beginners 2017

Best Online Stock Brokers for Beginners 2017 Get Double Points on Everything With the New Amex Blue Business Plus Card

Get Double Points on Everything With the New Amex Blue Business Plus Card A Northern Lights Cruise Is the Best Way to See the Natural Phenomenon

A Northern Lights Cruise Is the Best Way to See the Natural Phenomenon Get Two Free Hotel Nights Every Year With This $75 Annual Fee Card

Get Two Free Hotel Nights Every Year With This $75 Annual Fee Card